Mobile Broadband Distribution

Business Model Description

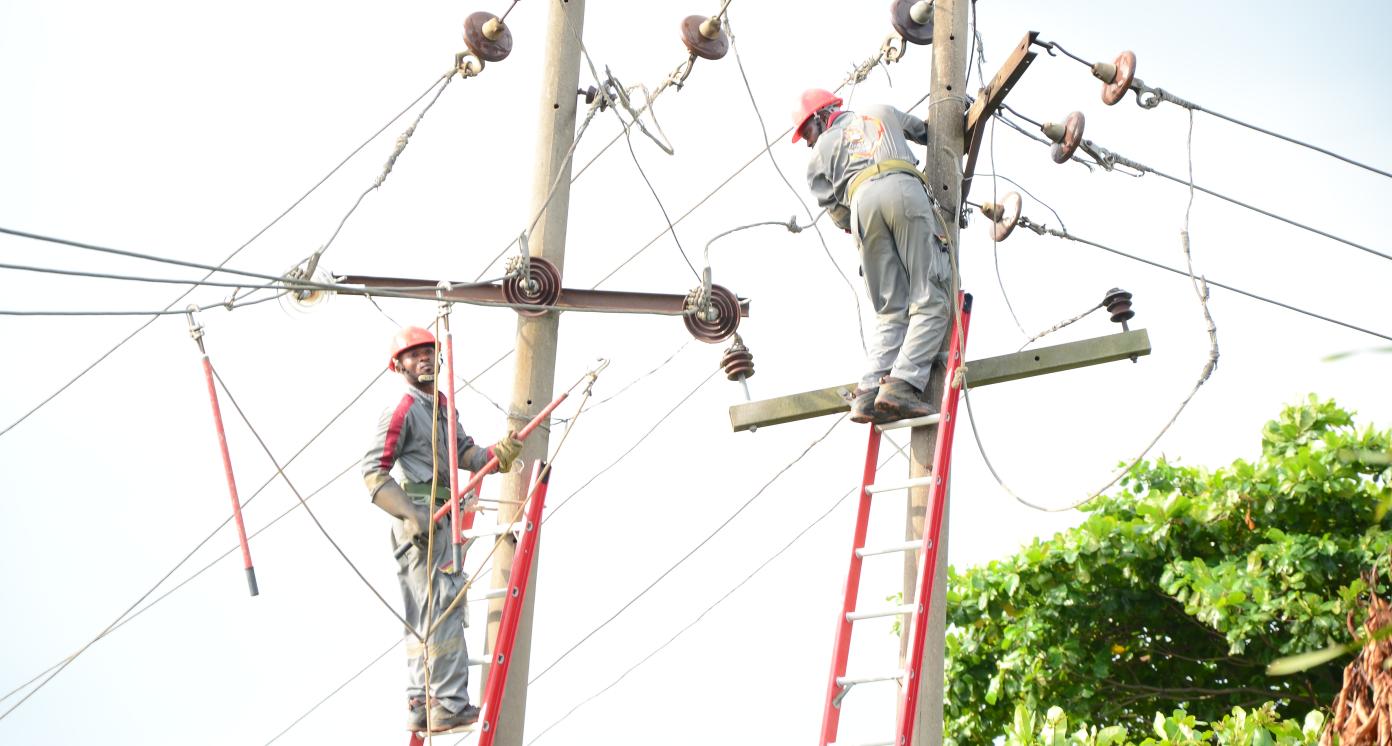

Invest in low-cost wireless broadband networks and develop mobile broadband infrastructure where assets are built and rented to users.

Expected Impact

Improve accessibility of information and income generating opportunities, and enhance access to services, such as education and healthcare.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Djibouti: Countrywide

- Djibouti: Obock

- Djibouti: Arta

- Djibouti: Ali Sabieh

Sector Classification

Technology and Communications

Development need

Access to telecommunications and internet services in Djibouti are limited, with an estimated mobile broadband penetration rate of 11.3% in 2018. Djibouti's ICT sector is one of the least developed in the region; the country ranks 158 out of 176 in the ICT Development Index (1).

Policy priority

To achieve the Vision 2035's policy objectives, Djibouti set out an ambitious National Strategy for ICT Development with the Integrated Strategic Plan (2014-2024), which aims to develop and spread access to ICT across the country. (1). The Horn of Africa Initiative also prioritizes establishing a single digital market as part of the regional infrastructure networks pillar (3).

Gender inequalities and marginalization issues

Djibouti exhibits a strong urban-rural divide in the technology and communications sector with only 0.7% of rural households declaring access to internet services. Additionally, fewer than 10% of internet users in Djibouti are women (1).

Investment opportunities introduction

Opportunities exist with regards to the ongoing partial privatization of telecommunications services, investments in hospitals and schools for further internet connectivity, and investments in the broadband network.

Key bottlenecks introduction

Challenges in the sector relate to the absence of competition in the ICT market deterring investment, limited service delivery and innovation, high prices of connection and services, underdeveloped cybersecurity, and weak privacy and data protection laws.

Internet Media and Services

Development need

55% of Djibouti's population has access to internet primarily through mobile phones; of which 71.3% are urban and 0.7% are rural households, which indicates the large urban-rural divide. Djibouti has among the highest fees for internet and some of the lowest speeds. Only the wealthiest parts of Djibouti's population have access to high-speed internet (1).

Policy priority

Djibouti's Vision 2035 seeks to strengthen the ICT sector to provide quality telecommunication services at affordable prices and to leverage the potential of digital technologies as a driver of economic growth (2). Prioritized projects of the Horn of Africa initiative include submarine cable and data infrastructure, cybersecurity, e-government and regulatory harmonization (3).

Investment opportunities introduction

Djibouti's geographic position enables productivity gains as the country houses the highest number of international gateway connections in East Africa, which also provide data provisioning to neighboring countries. Djibouti is connected to eight submarine cables (5).

Internet Media and Services

Pipeline Opportunity

Mobile Broadband Distribution

Invest in low-cost wireless broadband networks and develop mobile broadband infrastructure where assets are built and rented to users.

Business Case

Market Size and Environment

< 5%

Djibouti has 546,300 internet users

As of 2020, 546,300 internet users are active in Djibouti. This number has increased by 8,278 between 2019 and 2020, which signals a 1.5% growth. Overall internet penetration in Djibouti stands at 56% (9); mobile broadband internet penetration is lower at 11.3% (11).

Djibouti has access to eight major international fiber optic systems and is home to the first and only carrier neutral data center facility in East Africa (13).

Across the larger East Africa region, 186 million mobile broadband connections (covering 3G, 4G or 5G) are forecast by 2022 (12).

Indicative Return

ROE of 5% - 10%

The estimated return rate for investors in mobile broadband distribution is 7.1-9.1%. This rate is a benchmark calculated as a cost of equity, reflecting an average return required by investors active in the subsector (10).

Investment Timeframe

Short Term (0–5 years)

Based on studied benchmark projects, investments in mobile broadband services can see cashflow within a year once fiber cables have been installed (10).

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Market - High Level of Competition

Business - Supply Chain Constraints

Capital - CapEx Intensive

Impact Case

Sustainable Development Need

Despite Djibouti's expansive optical fiber network, broadband services are expensive, and subscriber and line connection fees are high given the country's poverty rate (14).

The mobile broadband internet penetration in Djibouti was estimated to be just 11.3% in 2018. Accessibility, quality and cost are major constraints to the digital development in the country. Djibouti ranked the 161st most expensive country in broadband pricing and 133rd in terms of speed (11).

Studies indicate a strong correlation between broadband availability and jobs and GDP growth. Globally, the COVID-19 pandemic has enhanced the digital divide and the need for reliable, fast and affordable internet connectivity (15).

Gender & Marginalisation

Women represent less than 10% of internet users in Djibouti (11), hindering their access to education and healthcare.

High subscription costs to broadband internet services in Djibouti exclude rural populations and low-income households from accessing information and economic opportunities (14).

Expected Development Outcome

Low-cost wireless broadband networks enhance access to affordable, fast and reliable internet connectivity.

The mobile broadband infrastructure increases access to services, such as education and healthcare, improve the ease of doing business especially for small enterprises.

Gender & Marginalisation

Mobile broadband networks increase women's access to online services, including education and healthcare, and contribute towards closing the digital gap between urban-rural communities and income levels.

Primary SDGs addressed

9.c.1 Proportion of population covered by a mobile network, by technology

23.63 mobile broadband subscriptions per 100 people (16).

100 in the long term (globally) (16).

17.6.1 Fixed Internet broadband subscriptions per 100 inhabitants, by speed

17.8.1 Proportion of individuals using the Internet

10 MBPS: 598, 256KT2MBPS: 20452, 2MT10MBPS: 3366, ANYS: 24416 (2019) (17).

55.68 per 100 people (2017) (17).

N/A

N/A

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Corporates

Public sector

Indirectly impacted stakeholders

People

Corporates

Outcome Risks

Broadband internet infrastructure may result in disruptions in natural habitats and increase greenhouse gas emissions, which can cause environmental degradation.

Greater internet accessibility may lead to overuse, which may result in addiction, impede the user's cognitive development and negatively impact on social relationships (18).

Impact Risks

Poor infrastructure and limited technical know-how for broadband internet may disrupt the delivery of the expected impact if the infrastructure is not set up and managed well.

If accessibility is not ensured for low-income communities and rural populations, the impact of the internet solutions may be limited as they would only reach groups already enjoying connectivity.

People with limited literacy and digital skills, including women and youth, may be excluded from using internet services, which would limit the scale and inclusiveness of the expected impact (19).

Impact Classification

What

Mobile broadband distribution enables greater internet accessibility to obtain information, income generating opportunities and access to services, such as education and healthcare.

Who

Remote communities and unserved population excluded from information system benefit from affordable internet services.

Risk

While the model of mobile broadband distribution is proven, infrastructure investments, affordability for those left behind, and users' limited digital skills require consideration.

Impact Thesis

Improve accessibility of information and income generating opportunities, and enhance access to services, such as education and healthcare.

Enabling Environment

Policy Environment

Strategy for Accelerated Growth and Employment Promotion (SCAPE) 2015-2019, 2014: Identifies the upgrade of the profile of the economy with modernized infrastructure and reformed sectors, including advances in telecommunications and ICT, as the main goal under the first phase of the strategy (20).

Vision Djibouti 2035, 2014: Aims to develop a diversified and competitive private sector driven economy, including an inclusive digital economy. It highlights Djibouti's submarine cable infrastructure potential (21).

National Strategy for ICT Development, 2014: Sets an ambitious strategy for ICT development and adopts a ten-year ICT roadmap, which aims to develop and generalize access to ICT across the country (11, 22).

Financial Environment

Financial incentives: The Horn of Africa Initiative implements projects in digital infrastructure with, which include the Festoon Cable and Terrestrial Links; Regional Data Market Infrastructure and Cybersecurity; and Data Services Market: E-Government and Cross-Border Digital Payments (32).

Other incentives: Djibouti has access to eight submarine cables: DARE 1, SeaMeWe3, Aden-Djibouti, EASSy/WIOC, SEACOM, EIG, Djibouti-Ethiopia, and Djibouti-Somalia, which provide an opportunity for the country's ICT sector at large (25) .

Regulatory Environment

Law No. 80, 2014: Outlines the adoption of the Integrated Strategic Plan, the Government's ten-year ICT development roadmap covering 2014-2024 (19).

Law No. 80, 2004: Aims to reform the ICT sector and calls for the establishment of the regulatory authority Djiboutian Agency for the Regulation of Telecommunications (ADRT) (23).

Law No. 74, 2019: Establishes the Djiboutian Multisector Regulatory Authority (ARMD) to cover the telecommunications, post and energy sectors (11, 24).

Press Release of the Parliamentary Session, 2021: Presents the draft law relating to the terms and conditions for the sale of state holdings in the capital of public enterprises; amends 1997 law relating to the conditions and modalities of privatization (33).

Marketplace Participants

Private Sector

Djibouti Telecom (Evatis, Adjib), Telecom Italia Sparkle, Saudi Telecom Company (STC), Algerie Telecom, Djibouti Data Centre (DDC), AfriMax, Ericsson.

Government

Ministry of Communications, Ministry of Economy and Finance, Djiboutian Multisector Regulatory Authority (ARMD), Central Bank of Djibouti, National Agency for State Information Systems (ANSIE).

Multilaterals

International Telecommunications Union (ITU (WiMAX), Broadband Commission for Development, African Union (AU), World Bank, International Monetary Fund (IMF), GSM Association (GSMA), Horn of Africa Initiative (HoAI).

Non-Profit

Djibouti Chamber of Commerce, Center for Leadership and Entrepreneurship (CLE), Center for Technology and Innovation for Development (CTID).

Public-Private Partnership

In 2017, Djibouti Telecom signed an MOU with GoToNetworks in for the Australia West Express cable (27). In 2018, it signed an MOU and a landing party agreement with Pakistan for the PEACE Cable International Network (26).

Target Locations

Djibouti: Countrywide

Djibouti: Obock

Djibouti: Arta

Djibouti: Ali Sabieh

References

- (1) World Bank. October 2020. Djibouti Digital Foundations Project Information Document. https://documents1.worldbank.org/curated/en/854401603922890710/text/Concept-Project-Information-Document-PID-Djibouti-Digital-Foundations-Project-P174461.txt.

- (2) Republic of Djibouti. 2014. Vision Djibouti 2035. http://ccd.dj/w2017/wp-content/uploads/2016/01/Vision-Nationale.pdf.

- (3) Horn of Africa Initiative. February 2021. Description of Priority Projects and Readiness. https://hoainitiative.org/wp-content/uploads/2021/03/HoAI-Project-Profiles.pdf.

- (4) Horn of Africa Initiative. 2020. Key Priority Projects to Deepen Regional Integration. https://hoainitiative.org/wp-content/uploads/2020/11/HoA-Initiative-KEY-PRIORITY-PILLARS-Brochure_FINAL.pdf.

- (5) Oxford Business Group. 2018. Global and local stakeholders to leverage Djibouti's unique position to develop ICT, https://oxfordbusinessgroup.com/overview/key-advantage-both-global-and-local-levels-stakeholders-are-leveraging-country’s-unique-position.

- (6) ITU News. May 2019. How Djibouti’s wireless networks are connecting ‘last-mile’ communities. https://news.itu.int/how-djiboutis-wireless-networks-are-connecting-last-mile-communities.

- (7) IFC. Supporting Wireless Broadband in Africa. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/wireless-broadband-africa.

- (8) IFC. 2013. Afrimax Raises $56 million of Equity to Deliver Sub-Saharan Africa’s Largest and Most Advanced 4G Network. https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=17853.

- (9) Simon Kemp. February 2020. Digital 2020: Djibouti. https://datareportal.com/reports/digital-2020-djibouti.

- (10) PwC / UNDP Analysis, based on Prof. A. Damodaran data, 2020. Not publicly available.

- (11) World Bank. October 2020. Djibouti Digital Foundations Project Information Document.

- (12) Connecting Africa. June 2018. East Africa to Have 186M Mobile Broadband Connections by 2022: Ovum. http://www.connectingafrica.com/document.asp?doc_id=744053.

- (13) Djibouti Data Center. 2021. About. http://www.djiboutidatacenter.com/en/page/about.

- (14) ITU. 2018. Measuring the Information Society Report 2018. https://www.itu.int/en/ITU-D/LDCs/Documents/2017/Country%20Profiles/Country%20Profile_Djibouti.pdf.

- (15) Deloitte. April 2021. Broadband for all: charting path to economic growth. https://www2.deloitte.com/content/dam/Deloitte/us/Documents/process-and-operations/us-broadband-for-all-economic-growth.pdf.

- (16) Sustainable Development Report. 2021. Country Profiles: Djibouti. https://dashboards.sdgindex.org/profiles/djibouti.

- (17) UN Global SDG Database, 2021. SDG Indicators. https://unstats.un.org/sdgs/indicators/database.

- (18) Quaglio, G. and Millar, S. 2020. Potentially Negative Effects Of Internet Use. European Parliament. https://www.europarl.europa.eu/RegData/etudes/IDAN/2020/641540/EPRS_IDA(2020)641540_EN.pdf.

- (19) GSM Alliance (GSMA). 2020. The State of Mobile Internet Connectivity Report 2020. https://www.gsma.com/r/wp-content/uploads/2020/09/GSMA-State-of-Mobile-Internet-Connectivity-Report-2020.pdf.

- (20) Government of Djibouti. 2015. Strategie de Croissance Accélérée et de Promotion de l'Emploi. https://economie.gouv.dj/wp-content/uploads/de95d383afef8bcbe0a3bc609a7f5c76.pdf.

- (21) Republic of Djibouti. 2014. Vision Djibouti 2035. http://ccd.dj/w2017/wp-content/uploads/2016/01/Vision-Nationale.pdf.

- (22) Government of Djibouti, Ministry of Communications. 2021. Djibouti Numérique. https://communication.gouv.dj/pages/DetailPages/76.

- (23) Government of Djibouti, Ministry of Communications. 2021. Présentation du secteur des Postes et des Télécommunications. https://communication.gouv.dj/pages/DetailPages/48.

- (24) Presidency of the Republic of Djibouti. 2021. Loi N° 74/AN/20/8ème L portant création de l'autorité de régulation multisectorielle de Djibouti (ARMD). https://www.presidence.dj/texte.php?ID=74&ID2=2020-02-13&ID3=Loi&ID4=3&ID5=2020-02-13&ID6=n.

- (25) Resilient Digital Africa. February 2021. Djibouti-Crossroads of submarine cables. https://resilient.digital-africa.co/en/blog/2021/02/03/djibouti-crossroads-of-submarine-cables.

- (26) Submarine Cable Networks. August 2018. PEACE Cable Initiates Landing Cooperation with Pakistan and Djibouti. https://www.submarinenetworks.com/en/systems/asia-europe-africa/peace/peace-cable-initiating-landing-cooperation-with-pakistan-and-djibouti.

- (27) Capacity Media. January 2017. Djibouti Telecom to take capacity on new Australia West Express cable. https://www.capacitymedia.com/articles/3654545/djibouti-telecom-to-take-capacity-on-new-australia-west-express-cable.

- (28) Republic of Djibouti. 2017. Plan de development rural de Obock. https://www.academia.edu/37693835/PLAN_DE_DEVELPPEMENT_RURAL_OBOCK_final_08_03_2017_pdf.

- (29) Republic of Djibouti. 2017. Plan de development rural de Arta. https://www.academia.edu/37693833/PLAN_DE_DEVELPPEMENT_RURAL_ARTA_final_08_03_2017_pdf.

- (30) Developing Telecoms. September 2020. Djibouti benefits from completion of the DARE cable system. https://developingtelecoms.com/telecom-business/market-reports-with-buddecom/10027-djibouti-benefits-from-completion-of-the-dare-cable-system.html.

- (31) Jason McGee-Abe. August 2018. Pakistan, Djibouti land deals for 60Tbps Peace subsea cable. https://www.capacitymedia.com/articles/3822295/pakistan-djibouti-land-deals-for-60tbps-peace-subsea-cable.

- (32) Horn of Africa Initiative. February 2021. Description of Priority Projects and Readiness. https://hoainitiative.org/wp-content/uploads/2021/03/HoAI-Project-Profiles.pdf.

- (33) Presidency of the Republic of Djibouti. 2021. Communiqué de la 11ème Séance du Dimanche 11/07/2021. https://www.presidence.dj/conseilministresuite.php?ID=11&ID2=2021-07-11.