Medical Devices Production

Business Model Description

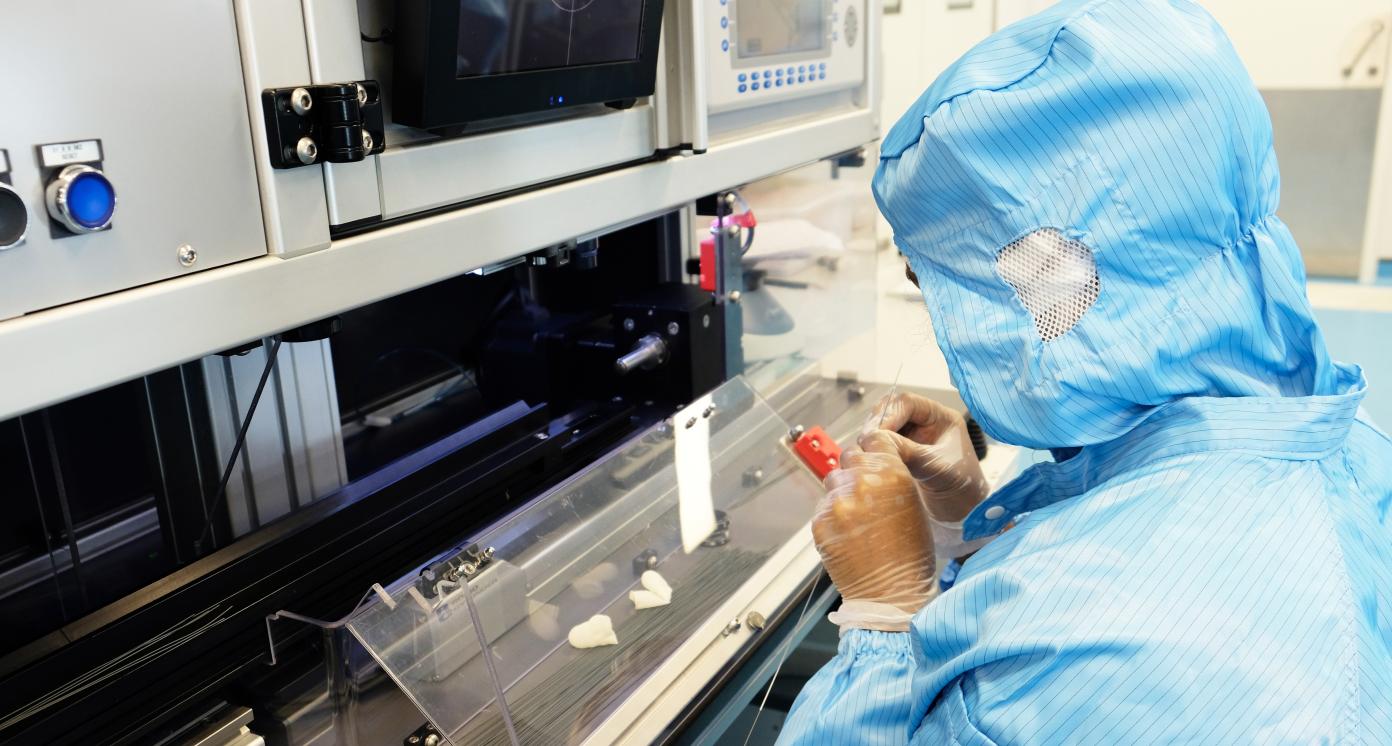

Design and manufacture medical devices such as catheters, medical balloons and stents that are utilized in various branches of medicine, including cardiology, radiology, gastroenterology and urology, which are competitive across global markets, including North America, South Eastern Asia and Western Europe.

Expected Impact

Increase self-sufficiency of the health care system, accessible at affordable costs, and expand regional supply chains to advance export potential.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Mauritius: Countrywide

- Mauritius: Moka

- Mauritius: Port Louis

Sector Classification

Health Care

Development need

Prevalence of noncommunicable diseases (NCDs), aging population with increasing needs and ensuring well-being of non-nationals living, working or visiting Mauritius urge improvements in country's well-developed healthcare system. Cost and supply chain vulnerabilities arise from dependency on medical equipment and pharmaceutical imports and specific treatments abroad (1, 2).

Policy priority

Mauritius aims to sustain provision of free healthcare services to an aging population with higher specialized treatment needs and quality expectations, through Five-Year Health Sector Strategic Plan 2020-2024 (3). Government agenda foresees positioning Mauritius as a medical hub, improving the independence of the sector and enhancing local production to serve wider Africa market.

Gender inequalities and marginalization issues

Serving Rodrigues and Agaléga and enhancing the well-being of the population in remote islands are strategic actions for the government (3). Self-perceived health is higher among men as only 67% of women rated their health status as ‘good or very good’ compared to 76% of men (4).

Investment opportunities introduction

Economic Development Board (EDB) Mauritius directs the efforts in situating the country as a medical hub (5). Government offers free healthcare services and allocate some MUR 14.5 billion (USD 300 million) to health budget (6). Various incentives, Extensive Exclusive Economic Zone (EEZ) and untapped marine resources stand as prospects for the sector (7).

Key bottlenecks introduction

Growing burden of noncommunicable diseases (NCDs) and high reliance on medical equipment and pharmaceutical imports are the key challenges. Certain specialized treatment cannot be undertaken in Mauritius and patients must be sent abroad. Absence of a central computerized data repository for health and lack of strong regulation limit the development of the sector (3).

Medical Technology

Development need

In 2020, Mauritius spent MUR 10,233 (USD 250-300) per capita on health and USD 30.5 million on medical equipment imports (8,9). Considering the growing medical needs and the need for enhancing industry’s competitiveness, developing an innovative, export-oriented sector, based on technology and research and development is key for achieving the knowledge hub national objective.

Policy priority

Mauritius government is committed to promote medical equipment industry with issuing tenders on a regular basis and aims to create regional value chains for medical devices (2, 11, 12). In 2021-2022 budget, the government allocated USD 52.4 million for the construction of multiple healthcare centers as well as for the acquisition of medical equipment for local hospitals (6).

Gender inequalities and marginalization issues

In Mauritius, more female than male are affected by cancer, and elderly represent one third of patients. Improving medical technology will reduce women's exposure to the risks of delayed diagnosis and increase the likelihood of early detection in noncommunicable diseases (NCDs), which disproportionately affect women (3, 44, 43).

Investment opportunities introduction

Advanced IT infrastructure, sectoral experience, and exporting potential to SADC and COMESA enhances medical device industry that medical devices export reached USD 24.5 million in 2021 (12, 56). In 2019, Indian government provided USD 23 million grant to open a new ear, nose and throat (ENT) hospital and a new cancer hospital was inaugurated in 2021 (8).

Key bottlenecks introduction

Burdensome and confining regulations and procedures for new medical device entry in the market, skill shortages and mismatch in the labor force, dependency on importing raw materials, weak intellectual property and patents protection, limited research and development are the key bottlenecks of the subsector (12).

Medical Equipment and Supplies

Pipeline Opportunity

Medical Devices Production

Design and manufacture medical devices such as catheters, medical balloons and stents that are utilized in various branches of medicine, including cardiology, radiology, gastroenterology and urology, which are competitive across global markets, including North America, South Eastern Asia and Western Europe.

Business Case

Market Size and Environment

15% - 20%

Mauritius’ merchandise exports for instruments used in medical, surgical, dental and other practices were USD 30 million in 2018 with 15.8% CAGR (15 years). In 2019, the number of medical devices manufacturer companies reached seven with 600 employees and an export turnover of USD 27 million (19).

19 area health centers, 114 community health centers, 6 medi-clinics, and 2 community hospitals provided primary health care (PHC) services in Mauritius in 2019 (9).

Africa is expected to require physical healthcare assets’ investment of USD 25 - 30 billion by 2022 (20). In 2025, the global medical device market is estimated to reach USD370 billion (21).

Indicative Return

> 25%

Natec Medical, which manufactures angioplasty balloon catheters, recorded a gross profit margin of 45% from a turnover of MUR 682,215,343 (USD 16.9 million) in 2021 (40).

FCI-SUD, which operates in the medical devices sector and produces ophthalmic implants, recorded gross profit margin of 41% in 2020 (41).

Investment Timeframe

Medium Term (5–10 years)

Natec Medical, which manufactures angioplasty balloon catheters, set up their facility in Mauritius in 2000, achieved global certificates and accreditations in less than five years and generated returns to extend facilities in ten years (55).

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Capital - CapEx Intensive

Market - High Level of Competition

Business - Supply Chain Constraints

Impact Case

Sustainable Development Need

In 2016, noncommunicable diseases (NDCs) accounted for 89% of all deaths in Mauritius, and in 2019, 595 per 100,000 people died from chronic diseases, which were around 550 in 2018 (26, 27). MUR 16.50 billion was spent on treatment of NCDs in 2016 (34).

In 2020, the Mauritius government's import of medical devices amounted to USD 30.5 million and the healthcare sector remains heavily reliant on medical device imports, which are critical for an effective healthcare system (8, 23).

According to the government's household budget survey of 2017, 3.8% of the household budget was spent on health expenditures, reaching 5% in rural areas (29). Although health services are free in Mauritius, due to the high dependency on the import of medical diagnostic technologies for chronic diseases, health costs are rising (60).

Gender & Marginalisation

Women are generally more affected by cancer than male in Mauritius (1,421 cases out of 2,380 in 2018), with women breast cancer being the most common type of cancer in 2020 (44, 10). Thus, developing early detection and treatment tools is crucial to preserve women health (44).

The elderly represent a significant portion of patients in Mauritius, as one third of patients are aged 65 or older; they require specific attention, as well as enhanced integrated medical care (3).

Expected Development Outcome

Local medical devices production increase the resilience of Mauritius' healthcare sector to crisis, and provides self-sufficiency, which is key for efficiency, while reducing high health expenditures of households to achieve the objective of less than 3% incurring such costs by 2024 (12, 3).

Medical devices production, through its technology advancements, increases life expectancy while decreasing chronic disease mortality due to effective diagnose and treatment capabilities (3).

Medical devices production increases access to medical devices for the domestic market, develops regional value chains for the sector and generates profit from the export activities in the region (12).

Gender & Marginalisation

Medical devices production fosters enhanced access for women, which supports early cancer detection with greater ease for treatment solutions (42, 23).

Medical devices production fosters supports the elderly since they can have preventive, diagnostic or therapeutic usage and support the treatment of noncommunicable diseases or other diseases particularly current in this target population (43).

Primary SDGs addressed

3.4.1 Mortality rate attributed to cardiovascular disease, cancer, diabetes or chronic respiratory disease

3.8.2 Proportion of population with large household expenditures on health as a share of total household expenditure or income

238.3 for cardiovascular disease, 129.6 for cancer, 176.6 per diabetes, 9.7 for chronic respiratory disease in 2020 (population aged 30 to 70 years, per 100.000 people) (28).

3.8% of household budget spent on health expenditures, which accounts for MUR 1,087 (USD 25) in 2017 (29).

Mauritius government aims to reduce overall mortality from cardiovascular diseases, cancer, diabetes, and chronic respiratory diseases by 5%, in 2024 (3).

Private health expenditure surpassed general government health expenditure in Mauritius, and out-of-pocket expenditure on health accounted for 45.7% of the total expenditure (32, 33). By 2024, the target is less than 3% of the population incurring catastrophic health expenditures (very high amount spent on healthcare in relation to income that one must cut down on necessities such as food) (3).

9.b.1 Proportion of medium and high-tech industry value added in total value added

9.2.1 Manufacturing value added as a proportion of GDP and per capita

Based on the World Bank collection of development indicators, medium and high-tech manufacturing value added was 4.65% in 2019 (30).

Manufacturing value added as a proportion of GDP was 12.1% and manufacturing value added per capita was MUR 36,086 (USD 810) in 2020 (28).

Mauritius government's objective for manufacturing industry growth, including medical device production and pharmaceutical manufacturing, is to increase manufacturing gross value added to USD 3.6 billion (12).

Mauritius government targets to reach manufacturing GVA of USD 3.6 billion and 25% of GDP contribution by 2030 (12).

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Indirectly impacted stakeholders

People

Corporates

Public sector

Outcome Risks

Medical devices contain hazardous materials, including toxic, flammable, and reactive raw materials, which may result in contamination of the environment during production and disposal (35).

Sustainable medical device manufacturing with increased energy efficiency and logistics optimization should be considered since the health sector accounts for 4.6% of global emissions (37, 38).

Impact Risks

Domestically manufactured medical devices may not address principal public health needs or may not be affordable for low-income communities, which may lower the expected impact.

The population may be hesitant to use the medical devices due to data privacy concerns (39), which may limit the uptake.

Patients, users and medical personnel may be exposed to use-related hazards, including those caused by mechanical failure, so that delivery do not result according to expected impact (36, 54).

Impact Classification

What

Medical devices production reduces Mauritius' dependency on imports and creates regional supply chains, lowers the cost of health care, and increases the quality and effectiveness in delivery.

Who

Patients and practitioners in Mauritius and the region benefit from the resilient and effective health care system enhanced by medical technologies.

Risk

Low-levels of domestic uptake, malfunctioning errors and the risk that medical devices are not produced according to public health needs may hinder the ability to deliver impact.

Contribution

While increasing access to locally produced affordable medical technologies, medical device production contributes to economic growth and exports, alongside manufacturing sub-sectors such as textiles and food processing.

How Much

Export of medical devices contributes USD 32 million to Mauritian economy amid the government targets to reach manufacturing gross value added of USD 3.6 billion by 2030 (2, 28).

Impact Thesis

Increase self-sufficiency of the health care system, accessible at affordable costs, and expand regional supply chains to advance export potential.

Enabling Environment

Policy Environment

Industrial Policy and Strategic Plan for Mauritius, 2020-2025: Supports the continued growth of Mauritius’ industrial capabilities. It develops a vision and strategic objective for eight sectors to be strengthened, including for medical devices (45).

Health Sector Strategic Plan 2020-2024: Promotes an enhanced access to better quality healthcare services and health technologies. It mentions that access to medical technologies is a human right and aims at a greater access to medical devices (3).

Financial Environment

Financial incentives: The Medical Credit Fund Africa, in partnership with the Bank of Mauritius, offers loans up to USD 2.5 million for capacity building and technical assistance for small and medium-sized healthcare businesses across Sub-Saharan Africa (51).

Fiscal incentives: 8-year income tax holiday, duty-free and VAT free on goods and equipment imported into freeport zones, exemption from corporate tax, sea freight rebate scheme (up to 25% of basic costs) for exports, tax incentives for research and development apply for medical devices production (52).

Other incentives: The Industrial Policy and Strategic Plan recommends the establishment of a Manufacturing Upgrading Fund (MUF) of MUR 1.9 billion (USD 43 million) over 5 years and a Modernization Investment Support Fund (MISF) of MUR 4.4 billion (USD 100 million) to 2025 (45).

Regulatory Environment

Clinical Trials Act: Establishes the Clinical Research Regulatory Council, Ethics and Pharmacovigilance Committees. It also states the conditions for the registration of Contract Research Organizations and the conduct of clinical trials (46).

Public Health Act, 1925: Regulates several aspects of life, including infectious or communicable diseases, epidemics, foods and water supply sanitation, as well as hospitals and dispensaries, and specifies that access to medicines and medical appliances shall be free of charge (47).

Human Tissue (Removal, Preservation and Transplant) Act, 2018: Establishes the legal framework for the removal, preservation and transplant of human tissue under appropriate medical supervision. It also creates the Tissue, Donation, Removal and Transplant Board (48).

Allied Health Professionals Council Act, 2017: Establishes the council which aims at regulating the professional conduct of allied health professionals and promoting the advancement of allied health professions. Its goal is to maintain discipline in the allied health professions (49).

Pharmacy Act, 1983: Establishes a Pharmacy Board, regulates the registration and examination of professionals, and regulates the trade of pharmaceuticals and their manufacturing in Mauritius (50).

Marketplace Participants

Private Sector

FCI-Sud, Lilmo, Natec Medical, Kasios, Envaste, Xtruline Ltd, HealthActiv. Abiolabs Ltd.

Government

Ministry of Health and Wellness, Economic Development Board, Central Procurement Board, Government of Japan, Government of India.

Multilaterals

World Health Organization (WHO).

Target Locations

Mauritius: Countrywide

Mauritius: Moka

Mauritius: Port Louis

References

- (1) Ministry of Foreign Affairs, Regional Integration and International Trade. 2019. Voluntary National Review Report of Mauritius. https://foreign.govmu.org/Documents/2020%20-%20migrated%20data/VNR%20REPORT/Mauritius%20VNR%20Report%202019(2).pdf.

- (2) International Trade Administration. 2018. Healthcare Resource Guide: Mauritius. https://2016.export.gov/industry/health/healthcareresourceguide/eg_main_116239.asp.

- (3) Republic of Mauritius - Ministry of Health and Wellness. 2020. Health Sector Strategic Plan 2020-2024. https://health.govmu.org/Documents/Main%20Page/Communique/HSSP%20Final%2004%20March%202021.pdf.

- (4) Republic of Mauritius Ministry of Finance, Economic Planning and Development - Statistics Mauritius. 2020. How Do Mauritians Feel About Their Health? https://statsmauritius.govmu.org/Documents/Census_and_Surveys/LCS/How%20do%20Mauritians%20feel%20about%20their%20health.pdf.

- (5) Economic Development Board Mauritius. 2021. Healthcare. https://www.edbmauritius.org/healthcare.

- (6) Government of Mauritius. 2021. Budget Speech 2021 – 2022 Better Together. https://budgetmof.govmu.org/Documents/2021_22budgetspeech_english.pdf.

- (7) International Trade Administration. 2021. Mauritius - Country Commercial Guide Biotechnology. https://www.trade.gov/country-commercial-guides/mauritius-biotechnology.

- (8) International Trade Administration. 2020 Mauritius - Country Commercial Guide Medical Equipment. https://www.trade.gov/country-commercial-guides/mauritius-medical-equipment#:~:text=In%202020%2C%20Mauritius%20imported%20%2430.5,Mauritius%2C%20employing%20approximately%20600%20people.

- (9) Republic of Mauritius Ministry of Health and Wellness. 2020. Annual Report on Performance for Financial Year 2019-2020. https://health.govmu.org/Documents/Legislations/Documents/Final%20Annual%20Report%20on%20Performance%20FY%202019-20.pdf.

- (10) Republic of Mauritius Ministry of Health and Wellness. 2020. Health Statistic Report 2020 Island of Mauritius and Rodrigues. https://health.govmu.org/Documents/Statistics/Health/Mauritius/Documents/HEALTH%20STATISTICS%20REPORT%202020.pdf.

- (11) Economic Development Board (EDB). 2021. Site Visit at Natec Medical. https://edbmauritius.org/newsroom/site-visit-natec-medical.

- (12) Ministry of Industrial Development, SMEs and Cooperatives & United Nations Conference on Trade and Development (UNCTAD). Industrial Policy and Strategic Plan 2020-2025. https://unctad.org/system/files/official-document/gdsinf2020d5_en.pdf.

- (13) Natec Medical. 2021. Natec Corporate Annual Report 2020-2021. https://www.natec-medical.com/assets/pdf/NATEC_CORPORATE_ANNUAL_REPORT_2021(Spread)_FA.pdf.

- (14) Natec Medical. About, What does NATEC do?. https://www.natec-medical.com/.

- (15) Mauritius Hindi News. 2021. Medical devices: Natec Medical in the expansion phase – Le Mauricien. https://mauritiushindinews.com/hindi-newspaper-in-mauritius/medical-devices-natec-medical-in-the-expansion-phase-le-mauricien/.

- (16) Envaste. History. http://www.envaste.com/?history,27.

- (17) Dun and Bradstreet. Envaste Ltd Overview. https://www.dnb.com/business-directory/company-profiles.envaste_ltd.e590f13467f1be8f855818a3208dffc8.html.

- (18) Dun and Bradstreet. LILMO LTD Overview. https://www.dnb.com/business-directory/company-profiles.lilmo_ltd.84d4bcd1a86fbdedd9671e5ca178da94.html.

- (19) Economic Development Board. 2019. Unlocking the potential of Mauritius’ healthcare & medical devices industry. https://edbmauritius.org/newsroom/unlocking-potential-mauritius-healthcare-medical-devices-industry.

- (20) Omnia Health. 2019. Healthcare in Sub-Saharan Africa: What are the answers?. https://insights.omnia-health.com/medical-specialities/healthcare-sub-saharan-africa-what-are-answers.

- (21) Euromonitor International. 2018. Top Countries to Drive Medical Device Manufacturing. https://www.euromonitor.com/top-countries-to-drive-medical-device-manufacturing/report.

- (22) Government of Mauritius. 2020. Best practices and experience of Mauritius’ preparedness and response to COVID-19 pandemic. https://reliefweb.int/sites/reliefweb.int/files/resources/Mauritius%20Inter-Action%20Review%201%20COVID-19%20%20Report.pdf.

- (23) World Health Organization (WHO). 2016. Towards improving access to medical devices through local production Phase II: report of a case study in four sub-Saharan countries. https://www.who.int/publications/i/item/9789241510141.

- (24) Macro Trends. World Life Expectancy 1950-2022. https://www.macrotrends.net/countries/WLD/world/life-expectancy.

- (25) Statistic Mauritius. 2020. Database on Quality of Life. https://statsmauritius.govmu.org/Pages/Statistics/By_Subject/QoLSD/SB_QoLSD.aspx.

- (26) World Health Organization. Mauritius. https://www.who.int/nmh/countries/mus_en.pdf.

- (27) Republic of Mauritius Ministry of Health and Wellness. 2019. Health Statistic Report 2019. https://health.govmu.org/Documents/Statistics/Health/Mauritius/Documents/HEALTH%20STATISTICS%20REPORT%202019.pdf.

- (28) Statistic Mauritius. 2020. UN SDG Database (2010-2020). https://statsmauritius.govmu.org/Pages/Statistics/By_Subject/SDGs/SB_SDG.aspx.

- (29) Ministry of Finance and Economic Development. 2019. Statistics Mauritius: Household Budget Survey 2017, Analytical Report. https://statsmauritius.govmu.org/Documents/Census_and_Surveys/HBS/Analytical_Report_2017.pdf.

- (30) Trading Economics. Mauritius - Medium And High-tech Industry (including Construction) (% Manufacturing Value Added). https://tradingeconomics.com/mauritius/medium-and-high-tech-industry-percent-manufacturing-value-added-wb-data.html.

- (31) Republic of Mauritius. 2017. Mauritius National Export Strategy Innovation Cross-Sector 2017-2021. https://www.intracen.org/uploadedFiles/intracenorg/Content/Redesign/Audience/policy_makers/2017-2021%20Mauritius%20-%20National%20Export%20Strategy,%20Innovation.pdf.

- (32) Ajoy Nundoochan1, Yusuf Thorabally, Sooneeraz Monohur and Justine Hsu. International Journal for Equity in Health. 2019. Impact of out of pocket payments on financial risk protection indicators in a setting with no user fees: the case of Mauritius. https://equityhealthj.biomedcentral.com/track/pdf/10.1186/s12939-019-0959-5.pdf.

- (33) World Bank. 2019. Out-of-pocket expenditure (% of current health expenditure) - Mauritius. https://data.worldbank.org/indicator/SH.XPD.OOPC.CH.ZS?locations=MU.

- (34) Laurent Musango1, Maryam Timol, Premduth Burhoo, Faisal Shaikh, Philippe Donnen and Joses Muthuri Kirigia. BMC Health Services Research. 2020. https://bmchealthservres.biomedcentral.com/track/pdf/10.1186/s12913-020-5039-4.pdf.

- (35) Wipro. Basic Principles of Risk Management for medical device design. https://www.wipro.com/medical-devices/basic-principles-of-risk-management-for-medical-device-design/.

- (36) Ebme. 2017. Hazards of Medical Electrical Equipment. https://www.ebme.co.uk/articles/electrical-safety/hazards-of-medical-electrical-equipment.

- (37) Manufacturing Chemist. 2021. Safety and sustainability in medical device manufacturing. https://www.manufacturingchemist.com/news/article_page/Safety_and_sustainability_in_medical_device_manufacturing/175852.

- (38) BioSpace. 2021. Global Warming Impact of “Single-Use” Medical Device Cut in Half When Reprocessed Device Used Instead, According to Newly Published Research in Sustainability. https://www.biospace.com/article/releases/global-warming-impact-of-single-use-medical-device-cut-in-half-when-reprocessed-device-used-instead-according-to-newly-published-research-in-sustainability/.

- (39) Green Light, by QRA Corp. 2019. 4 Biggest Challenges in Medical Device Manufacturing (And How to Overcome Them). https://www.greenlight.guru/blog/challenges-medical-device-manufacturing.

- (40) Corporate and Business Registration Department (CBRD). 2021. Information about NATEC MEDICAL LTD. https://companies.govmu.org:4343/MNSOnlineSearch/.

- (41) Corporate and Business Registration Department (CBRD). 2020. Information about FCI-SUD LTD. https://companies.govmu.org:4343/MNSOnlineSearch/.

- (42) World Health Organization. 2017. WHO list of priority medical devices for cancer management. https://apps.who.int/iris/bitstream/handle/10665/255262/9789241565462-eng.pdf.

- (43) World Health Organization. 2015. Systematic review of needs for medical devices for ageing populations. https://www.who.int/publications/i/item/9789241509220.

- (44) World Health Organization Africa. 2020. New Cancer Cases on the decrease in Mauritius. https://www.afro.who.int/news/new-cancer-cases-decrease-mauritius.

- (45) Ministry of Industrial Development, SMEs and Cooperatives (Industrial Development Division)-UNCTAD. 2020. Industrial policy and strategic plan for Mauritius (2020-2025). https://unctad.org/system/files/official-document/gdsinf2020d5_en.pdf.

- (46) EDB. 2021. Clinical Trials Guidelines. https://www.edbmauritius.org/sites/default/files/2021-09/CLINICAL%20TRIALS%20GUIDELINES_0.pdf.

- (47) President of the Republic of Mauritius. 1925. The Public Health Act 1925. https://health.govmu.org/Documents/Legislations/Documents/270921/PUBLIC%20HEALTH%20ACT%201925.pdf.

- (48) President of the Republic of Mauritius. 2018. Human Tissue (Removal, Preservation and Transplant) Act 2018. https://mauritiusassembly.govmu.org/Documents/Acts/2018/act0518.pdf.

- (49) President of the Republic of Mauritius. 2017. Allied Health Professionals Council Act 2017. https://mauritiusassembly.govmu.org/Documents/Acts/2017/act0917.pdf.

- (50) President of the Republic of Mauritius. 1983. The Pharmacy Act 1983. https://www.mcci.org/media/35844/the-pharmacy-act-1983.pdf.

- (52) Economic Development Board. Manufacturing Industry. https://edbmauritius.org/manufacturing-traditional-industries.

- (52) Economic Development Board. Manufacturing Industry, Attractiveness of Mauritius. https://edbmauritius.org/manufacturing-traditional-industries.

- (53) Prime Minister's Office, News. 2021. Launching of the Côte d’Or Data Technology Park. https://pmo.govmu.org/News/SitePages/Launching-of-the-C%C3%B4te-d%E2%80%99Or-Data-Technology-Park.aspx.

- (54) World Health Organization. Medical Devices: Managing The Mismatch An Outcome Of The Priority Medical Devices Project. https://apps.who.int/iris/bitstream/handle/10665/44407/9789241564045_eng.pdf.

- (55) Natec Medical Ltd. 2021. Natec Medical Ltd. Corporate Report 2020 - 2021. https://www.natec-medical.com/assets/pdf/NATEC_CORPORATE_ANNUAL_REPORT_2021(Spread)_FA.pdf.

- (56) Defimedia. 2022. Perspectives : le secteur manufacturier appelé à élargir ses horizons. https://defimedia.info/perspectives-le-secteur-manufacturier-appele-elargir-ses-horizons.

- (57) ICT Export Portal. ICT Habitats and Technology Parks. http://ictexport.govmu.org/English/ICT_in_Mauritius/ICT%20Infrastructure/Pages/ICT-Habitats-and-Technology-Parks.aspx.

- (58) Export.gov. 2019. Mauritius - Port Expansion. https://www.export.gov/apex/article2?id=Mauritius-port-expansion.

- (59) UN Habitat, Wiomsa. 2021. City Case Study Port Louis. https://www.arup.com/-/media/arup/files/publications/c/coastal-cities-and-the-blue-economy/blue-economy_case-study_port-louis-final-oct21.pdf.

- (60) Ajoy Nundoochan, International Journal for Equity in Health. 2020. Improving public hospital efficiency and fiscal space implications: the case of Mauritius. https://equityhealthj.biomedcentral.com/articles/10.1186/s12939-020-01262-9.