Affordable housing

Business Model Description

Deliver affordable housing for low and middle income households in suburban areas.

Expected Impact

Improved citizen wellbeing and support urban planning though affordable housing.

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

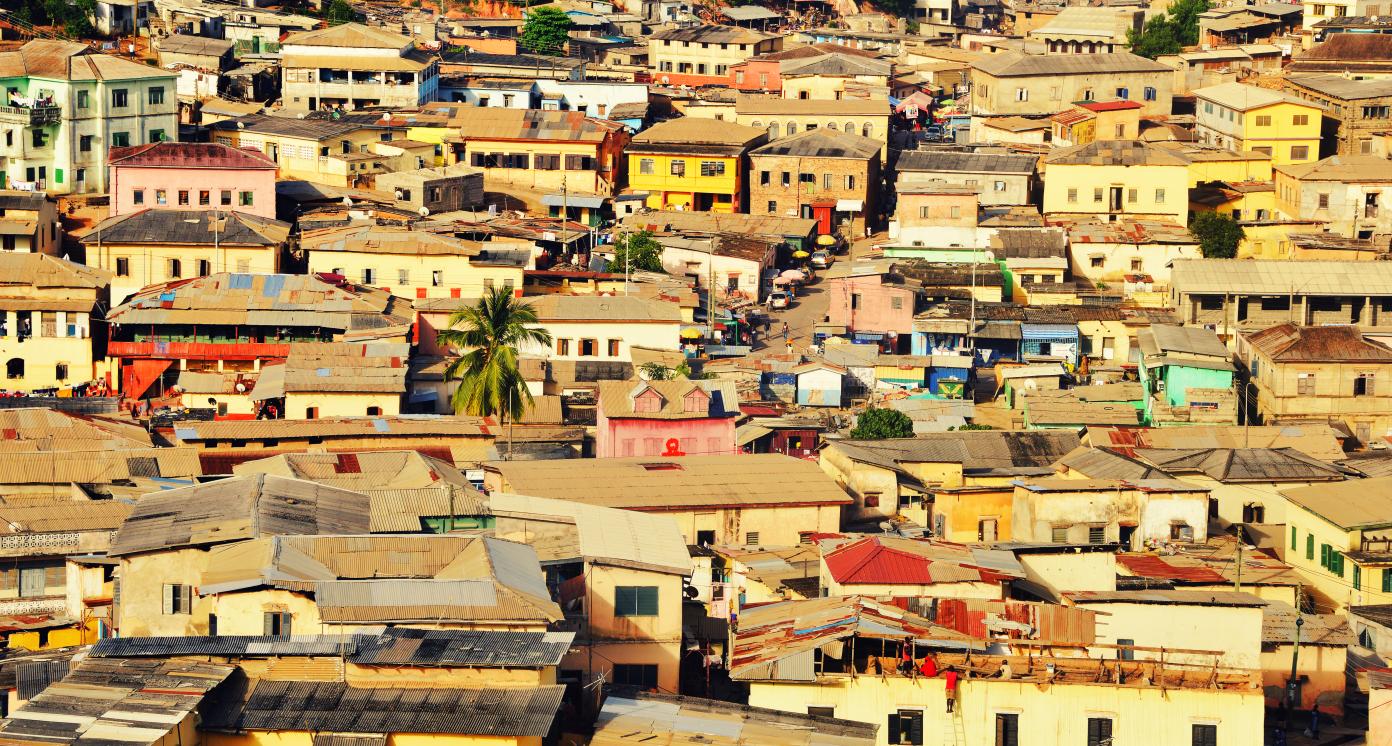

Country & Regions

- Ghana: Ashanti

- Ghana: Western Region

- Ghana: Northern

- Ghana: Greater Accra

Sector Classification

Infrastructure

Development need

SDG 6 - Clean Water and Sanitation and SDG 9 - Industry, Innovation and Infrastructure are reported to be major challenges and only moderately improving. Two out of five SDG 6 indicators and three out of six SDG 9 indicators are marked as major challenges.(II)

Policy priority

The government aims to increase the availability of water and sanitation. By 2021 Ghana wants basic water access to be over 80%, safely managed water access to be 36%, improved liquid waste management to be 30% and solid waste management to be 80%.(III) Roads are also a high priority with the target of 50% of good quality roads, 75,000 km of roads and over 67% of road maintained.(III) The government created the enabling environment for house construction, making the sector more attractive for investors.(IV) The Medium-Term Plan III forecasts the number of houses to reach 3.6 million in 2021.(III)

Investment opportunities

The country’s infrastructure sector recorded significant growth the past 20 years, which supported Ghana’s development. With a booming urban population (3.3% growth in 2019) (I), there are opportunities for the private sector to invest in housing, water and sanitation, roads and waste management.

Key bottlenecks

The main sector challenges include: liquidity problems for some ongoing projects, transmission problems, a lack of conservation, a weak regulatory environment, a lack of patient capital, difficult access to land, a lack of related services and the high cost of materials.

Home Builders

Pipeline Opportunity

Affordable housing

Deliver affordable housing for low and middle income households in suburban areas.

Business Case

Market Size and Environment

Ghana suffers a housing deficit of 1.7 million units.

In Ghana, the real estate subsector accounts for 2.7% of gross domestic product (GDP) and recorded 20% growth in 2019. The construction subsector accounted for 6.4% of GDP over the same period.(10)

The estimated housing deficit is more than 1.7 million units. Annual demand for houses is projected to be 100,000 units, but only 35% of this number is supplied.(5)

In 2019 57% of Ghana's 30.4 million people lived in cities. Further, in 2018, 30.4% of the urban population lived in informal settlements.(I)

Indicative Return

20% - 25%

The expected return profile depends on the type and size of the projects. Regional benchmark examples indicated an internal rate of return of 23%-26%.(1)

At large, Ghana's real estate subsector recorded a return on investment of 18% in 2017.(5)

A private equity investor active across Africa achieved an internal rate of return of 25.2% on constructing affordable housing.(2)

Investment Timeframe

Medium Term (5–10 years)

Stakeholders expect to achieve positive returns on affordable house construction in around 10 years.(12)

A leading investor in Ghana takes an average of 5 to 15 years to see positive returns on affordable housing projects completed by a small-scale contractor.(11)

Market Risks & Scale Obstacles

Capital - CapEx Intensive

Market - Highly Regulated

Business - Supply Chain Constraints

Impact Case

Sustainable Development Need

Ghanaians can often afford houses, but these houses are usually overcrowded. Around 50% of households occupy a single room and a further 27% has two rooms. Given the average family has 4 people, this situation poses serious threats to health and privacy challenges.(6)

Construction lending rates are high (around 28% in 2019), as are construction costs. Materials costs are high because around 80% of materials are imported. These two factors create challenges in developing and buying houses. Further, the lengthy land title registration process extends the whole process.(5)

Gender & Marginalisation

Low income communities have the least access to suitable living conditions.

Expected Development Outcome

Improve living conditions and quality of life, improve livelihoods of populations living in poverty

Ameliorate affordability of housing, decrease inequalities in access to housing for low and middle income families

Ameliorate affordability of housing, decrease inequalities in access to housing for low and middle income families

Gender & Marginalisation

Better living conditions that provide greater options for women to realise opportunities and support entire households

Primary SDGs addressed

1.2.1 Proportion of population living below the national poverty line, by sex and age

1.4.1 Proportion of population living in households with access to basic services

11.1.1 Proportion of urban population living in informal, informal settlements or inadequate housing

11.3.1 Ratio of land consumption rate to population growth rate

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Indirectly impacted stakeholders

Public sector

Outcome Risks

Constructing new houses can affect the value of already existing buildings in the surrounding areas.(16)

House construction causes soil sealing which contributes to possible land degradation and changes in groundwater.(14)

Impact Risks

Housing construction changes land use and may threaten wildlife by interfering with its natural habitat.

Impact Classification

What

Investing in the construction and development of affordable housing is likely to have a positive impact because it is solving accommodation challenges and can increase the wellbeing of citizens.

Who

Low and middle income households that cannot currently access affordable housing and have to live in poor conditions due to a shortage in the real estate market

Risk

The model is market proven, but there is a risk that the lack of materials and high interest rates can limit up-scaling of investment. Without proper city and regional planning, exponential growth of the sector can negatively affect the environment.

Impact Thesis

Improved citizen wellbeing and support urban planning though affordable housing.

Enabling Environment

Policy Environment

National Housing Policy 2015: This policy presents an overall strategy for affordable housing development. It aims at "creating an enabling environment to encourage the private sector to participate in housing delivery".(7)

Affordable Housing Project 2019: This project aims to provide 250,000 housing units annually over the next 8 years through public-private partnerships.(5)

Financial Environment

Financial incentives: Strategic investments over USD 50 million and in core sectors can negotiate specific incentives with the Ghana Investment Promotion Center.(3)

Fiscal incentives: In Ghana companies offering affordable housing approved by Ministry of Works and Housing are levied a 1% corporate income tax rate (instead of 25%) for the first 5 years.(3) A reduced value added tax of 5% applies to developers providing real estate for dwellings (instead of 12.5%).(13)

Other incentives: To facilitate housing construction, the government set up a National Housing and Mortgage Fund valued at around USD 180 million. The fund aims to leverage private funding and long-term capital to subsidize and refinance mortgages.(5)

Regulatory Environment

The government is processing the Real Estate Bill 2020, which will shape the sector when implemented.(12) The Ghana Building Code 2018 provides standards and recommendations for planning, management and building practices.(5)

Home Mortgage Finance Act No. 770 of 2008: This Act regulates mortgages and house financing, ensures customer protection and regulates the process of foreclosure in case of default.(5)

Land Use and Spatial Planning Act No. 925 of 2016 eased the land planning process. The Local Governance Act No. 936 of 2016 passed administration responsibility to local governments. The Land Bill of 2017 aimed at providing sustainable land administration.(5)

The Ministry of Works and Housing is the main regulatory body governing Ghana's construction sector in Ghana.(17) The Ghana Standards Authority sets engineering, building and basic standards.(18)

Marketplace Participants

Private Sector

Devtraco, Trasacco, Regimanuel Estates, Clifton Homes and CPL Developers, National Housing and Mortgage Fund

Government

Ministry of Works and Housing, Ghana Standards Authority

Multilaterals

World Bank, United Nations Office for Project Services (UNOPS)

Public-Private Partnership

Ghana Real Estate Developers Association, Government Affordable Housing Project, Centre for Affordable Housing Finance Africa

Target Locations

Ghana: Ashanti

Ghana: Western Region

Ghana: Northern

Ghana: Greater Accra

References

- (I) World Bank database. https://data.worldbank.org/ (II) Sachs, J., Schmidt-Traub, G., Kroll, C., Lafortune, G., Fuller, G., Woelm, F. 2020. The Sustainable Development Goals and COVID-19. Sustainable Development Report 2020. (III) Republic of Ghana (2017). Medium-Term National Development Policy Framework: An Agenda for Jobs: Creating Prosperity and Equal Opportunity for All (First Step) 2018-2021. https://s3-us-west-2.amazonaws.com/new-ndpc-static1/CACHES/PUBLICATIONS/2018/08/23/Medium-term+Policy+Framework-Final+June+2018.pdf (IV) Centre for Affordable Finance in Africa (2019). Africa Housing Finance Yearbook 2019 - Ghana Country Profile. http://housingfinanceafrica.org/app/uploads/V14-GHANA-PROFILEKF-2.pdf

- (1) Chilongo, M. (2015). 'Investment Theme: Access To Housing'. Bertha Centre for Social Innovation and Entrepreneurship, 2015, https://www.sbs.ox.ac.uk/sites/default/files/2019-01/Impact-theme-Acess-to-Housing.pdf

- (2) Rust, K. (2016). The Residential Investment Opportunity in Driving Economic Growth. Centre for Affordable Housing Finance in Africa.http://housingfinanceafrica.org/documents/the-residential-investment-opportunity-in-driving-economic-growth/

- (3) Ghana Investment Promotion Centre. Ghana incentives inventory. https://www.gipcghana.com/press-and-media/downloads/promotional-materials/33-ghana-incentives-inventory/file.html

- (4) Ghana Investment Promotion Centre (2017). Doing business in Ghana - To Know and Invest in Ghana.

- (5) Centre for Affordable Finance in Africa (2019). Africa Housing Finance Yearbook 2019 - Ghana Country Profile. http://housingfinanceafrica.org/app/uploads/V14-GHANA-PROFILEKF-2.pdf

- (6) Godwin, K. (2017). Unmasking the Myth of Affordable Housing in Ghana. Inclusive Business Action Network. https://www.inclusivebusiness.net/ib-voices/unmasking-myth-affordable-housing-ghana

- (7) Ministry of Water Resources, Works and Housing (2015). National Housing Policy. https://www.worldurbancampaign.org/sites/default/files/national_housing_policy_2015.pdf

- (8) Richter, S.,Vallianatos, H. and Aniteye, P. (2016). 'Migration, Health, and Gender and Its Effects on Housing Security of Ghanaian Women'. Global Qualitative Nursing Research. https://journals.sagepub.com/doi/pdf/10.1177/2333393617690288

- (9) Business World Ghana (2019). Government releases cash to 3 banks for new housing schemes. http://www.businessworldghana.com/govt-releases-cash-to-3-banks-for-new-housing-schemes/

- (10) Ghana Statistical Service (2020). Rebased 2013-2019 Annual Gross Domestic Product. https://statsghana.gov.gh/gssmain/storage/img/marqueeupdater/Annual_2013_2019_GDP.pdf

- (11) Inclusive Business Action Network (2016). Affordable Housing in Ghana - Sector study. https://www.inclusivebusiness.net/sites/default/files/2018-09/iBAN_Affordable-Housing_Ghana.pdf

- (12) UNDP/PwC Stakeholders Interviews, 2020.

- (13) KMPG. Ghana - Indirect Tax Guide. https://home.kpmg/xx/en/home/insights/2019/03/ghana-indirect-tax-guide.html#:~:text=5%20percent%20VAT%20flat%20rate,be%20used%20for%20a%20dwelling.

- (14) Recare. What is Soil Sealing? https://www.recare-hub.eu/soil-threats/sealing

- (15) Kugbega, S. (2015). Mortgage Finance in Ghana. The Graduated Payment Mortgage as a Panacea to Housing Affordability among Africa’s Middle Class. https://www.grin.com/document/303545

- (16) Rossi-Hansberg, E. and Sarte, P.D. (2012). Economics of Housing Externalities. https://www.princeton.edu/~erossi/EHE.pdf

- (17) Ministry of Works and Housing. Services. https://www.mwh.gov.gh/index.php/services/

- (18) Ghana Standards Authority. Engineering Building & Basic Standards. https://www.gsa.gov.gh/engineering-building-basic-standards/